A top options trader details a practical approach for pricing and trading options in any market condition The options market is always changing, and in order to keep up with it you need the greeks―delta, gamma, theta, vega, and rho―which are the best techniques for valuing options and executing trades regardless of market conditions. In…

Category: Options Trading

An option is a contract that allows (but doesn’t require) an investor to buy or sell an underlying instrument like a security, ETF or even index at a predetermined price over a certain period of time. Buying and selling options is done on the options market, which trades contracts based on securities.

Options are financial instruments used to hedge currency or interest rate risk. Currency options protect against unfavorable exchange rate movements while allowing the investor to take advantage of favorable movements in the exchange rate. Currency options are particularly useful when it is not sure whether the cash flow will occur or not.

As the name suggests, an option is basically an option. It gives the investor an option to exercise it if the exchange rate if favorable, if it is not favorable then the option does not have to be exercised.

Interest rate options allow an organization to limit its exposure to adverse interest rate movements while also allowing it to take advantage of favorable interest rate movements. Like currency options, interest rate options grant the investors or buyer of the option the right but not the obligation to deal at an agreed interest rate at a future date.

Interest rate options are used mainly by organizations to hedge the interest rates on their loans. Investors typically use currency options to hedge the risk of unfavorable exchange rate movements. Once again, the investors need to be a well versed and knowledgeable when dealing with options because they require a degree of technical proficiency. Suppose if an investor has to pay 5000 Euros 2 months and the home currency of the investor is expected to weaken against the Euro, then the investor can hedge this risk and buy an option to buy 5000 Euros at a price agreed today. 2 months later on the date of exercising the option, the investor can analyze if the exchange rate has weakened or strengthened. If the exchange rate has weakened according to the expectations then the investors may exercise the option and prevent his loss and if the expected change has not occurred then the investor may not exercise the option allowing it to lapse and trade using the spot rate that is more favorable. In this manner, currency options allow investors to hedge risk and avoid losses.

Many factors go into the price of an option. A trader cannot simply “buy calls” and expect to make money when the stock price rises. Much more is involved. … It is a poor strategy to buy (OTM) call options with a strike price of $50 if the average stock price move is $0.05 per day.

Profiting with Iron Condor Options: Strategies from the Frontline for Trading in Up or Down Markets (Paperback)

In a straightforward approach, Hanania Benklifa provides readers the practical knowledge needed to trade options conservatively in Profiting with Iron Condor Options: Strategies from the Frontline for Trading in Up or Down Markets. The objectives are simple: make 2%-4% a month staying in the market as little as possible. Market experts use option condors to…

Stock Market Investing for Beginners: The Top 101 Growth Stocks for 2019 – Including Marijuana Stocks, 5G Stocks, Penny Stocks and Dividends + How to Build a Starter Portfolio for Less than $100

Buy Now Investing, Everyman Click Buy Now for Updated Price. Estimated Price: $14.99 Click Buy Now for Updated Price. Estimated Price: 14.99 Buy Now %%item_customer_reviews%% Originally posted 2023-01-02 21:04:34. Republished…

Just Trade Candlestick chart for Stock Forex Market Traders T-Shirt

Funny tee for traders, whether you trade Stock Market, forex market, options or a Broker man, this tee is for you! Just Trade, Stock market Tee, Candlestick Chart.Great for Broker and Trader, Wall-Street experts and Business peopleLightweight, Classic fit, Double-needle sleeve and bottom hem

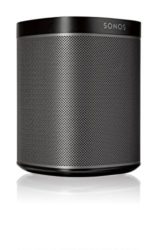

Sonos Play:1 – Compact Wireless Smart Speaker – Black (Discontinued by manufacturer)

Small yet powerful speaker for streaming music and more. Get rich, room-filling sound with Play:1, and control it with the Sonos app.The compact design fits just about any space. Put it on your kitchen countertop, or tuck it away on your office bookshelf.Go from unboxing to listening in minutes with just 1 cord and step-by-step…

Swing Trading for Beginners: The #1 Step by Step Guide to Create Passive Income in The Stock Market Trading Options.Real Strategies to Create $10 000/Month Machine.Money Management &Trading Psychology

Buy Now Martinez, Ryan Click Buy Now for Updated Price. Estimated Price: $13.49 Click Buy Now for Updated Price. Estimated Price: 13.49 Buy Now %%item_customer_reviews%% Originally posted 2021-02-19 04:14:58. Republished…

Options Trading: Easiest Beginners Simplified Guide , Effective Profitable Strategies – Learn the Foundamental Basics of Options Trading and Start Today

♦♦Bonus: Buy the Paperback version of this book, and get the kindle eBook version included for FREE**If you are looking for a way to ditch your boring old 9-to-5 job but aren’t interested in something that simply replaces that with the drudgery of working online, then perhaps some type of day trading is more your…

Options Trader T Shirt Stock Market Trading Shirt Money Gift

Options Trader Shirt is perfect for anyone that buys and sells options broker day trades the stock market or just loves money. If you trade Calls and Puts long term trading short term or swing trading you will love this t shirt.Stock Market T Shirt. Great gift for anyone who loves volatility when trading options.…

Immortals Fenyx Rising – Nintendo Switch Standard Edition

Wield the powers of the gods like Achilles’ sword and Daidalos’ wings to battle powerful enemies and solve ancient puzzles.Fight iconic mythological beasts like Cyclops and Medusa in dynamic combat in the air and on the ground.Use your skills and diverse weapons, including self-guided arrows, telekinesis, and more, for devastating damage.Discover a stylized open world…

Stock Market for Dummies: How to succeed in the stock market as a beginner and make your first profit

Buy Now Jay, Sam Jay, Sam Click Buy Now for Updated Price. Estimated Price: $5.99 Click Buy Now for Updated Price. Estimated Price: 5.99 Buy Now %%item_customer_reviews%% Originally posted 2022-09-27…