Are you tired of wasting your time on different trainings and spending thousands of dollars looking for proven ways to make real money? Do you want to know how to make your first $10k online by simply leveraging the hidden strategies of a trading expert with an exceptional track record? “Options Trading 2020” is written…

Category: Options Trading

An option is a contract that allows (but doesn’t require) an investor to buy or sell an underlying instrument like a security, ETF or even index at a predetermined price over a certain period of time. Buying and selling options is done on the options market, which trades contracts based on securities.

Options are financial instruments used to hedge currency or interest rate risk. Currency options protect against unfavorable exchange rate movements while allowing the investor to take advantage of favorable movements in the exchange rate. Currency options are particularly useful when it is not sure whether the cash flow will occur or not.

As the name suggests, an option is basically an option. It gives the investor an option to exercise it if the exchange rate if favorable, if it is not favorable then the option does not have to be exercised.

Interest rate options allow an organization to limit its exposure to adverse interest rate movements while also allowing it to take advantage of favorable interest rate movements. Like currency options, interest rate options grant the investors or buyer of the option the right but not the obligation to deal at an agreed interest rate at a future date.

Interest rate options are used mainly by organizations to hedge the interest rates on their loans. Investors typically use currency options to hedge the risk of unfavorable exchange rate movements. Once again, the investors need to be a well versed and knowledgeable when dealing with options because they require a degree of technical proficiency. Suppose if an investor has to pay 5000 Euros 2 months and the home currency of the investor is expected to weaken against the Euro, then the investor can hedge this risk and buy an option to buy 5000 Euros at a price agreed today. 2 months later on the date of exercising the option, the investor can analyze if the exchange rate has weakened or strengthened. If the exchange rate has weakened according to the expectations then the investors may exercise the option and prevent his loss and if the expected change has not occurred then the investor may not exercise the option allowing it to lapse and trade using the spot rate that is more favorable. In this manner, currency options allow investors to hedge risk and avoid losses.

Many factors go into the price of an option. A trader cannot simply “buy calls” and expect to make money when the stock price rises. Much more is involved. … It is a poor strategy to buy (OTM) call options with a strike price of $50 if the average stock price move is $0.05 per day.

Options Volatility Trading: Strategies for Profiting from Market Swings

Buy Now Warner, Adam Click Buy Now for Updated Price. Estimated Price: $34.49 Click Buy Now for Updated Price. Estimated Price: 34.49 Buy Now %%item_customer_reviews%% Originally posted 2020-07-18 08:06:46. Republished…

Credit Spread Options for Beginners: Turn Your Most Boring Stocks into Reliable Monthly Paychecks using Call, Put & Iron Butterfly Spreads – Even If The Market is Doing Nothing

Buy Now Publications, Freeman Click Buy Now for Updated Price. Estimated Price: $14.32 Click Buy Now for Updated Price. Estimated Price: 14.32 Buy Now %%item_customer_reviews%% Originally posted 2021-01-23 15:03:25. Republished…

Trading Journal: Stock and Options Trading Journal to Track and Analyze Trades for Trading Performance and Market Success for Day Trade, Swing Trade and Investment

Buy Now Journals, F. M. Click Buy Now for Updated Price. Estimated Price: $12.99 Click Buy Now for Updated Price. Estimated Price: 12.99 Buy Now %%item_customer_reviews%% Originally posted 2023-03-15 05:03:38….

Options Trading: A Beginner’s Crash Course in Profitable Strategies

Buy Now Benjamin, Warren Ray Click Buy Now for Updated Price. Estimated Price: $21.97 Click Buy Now for Updated Price. Estimated Price: 21.97 Buy Now %%item_customer_reviews%% Originally posted 2023-06-03 17:59:18….

Options Trading: Tips and Tricks to Win at Options Trading

Buy Now Johnson, Alex Click Buy Now for Updated Price. Estimated Price: $19.99 Click Buy Now for Updated Price. Estimated Price: 19.99 Buy Now %%item_customer_reviews%% Originally posted 2020-10-01 13:00:03. Republished…

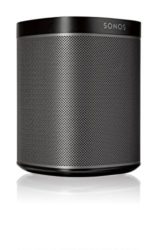

Sonos Play:1 – Compact Wireless Smart Speaker – Black (Discontinued by manufacturer)

Small yet powerful speaker for streaming music and more. Get rich, room-filling sound with Play:1, and control it with the Sonos app.The compact design fits just about any space. Put it on your kitchen countertop, or tuck it away on your office bookshelf.Go from unboxing to listening in minutes with just 1 cord and step-by-step…

Options Trading: THIS BOOK INCLUDES: Options trading for beginners and strategies. Find here the best tips to invest in the stock market and to make an income out of it

Buy Now Morris, Matthew Click Buy Now for Updated Price. Estimated Price: $41.77 Click Buy Now for Updated Price. Estimated Price: 41.77 Buy Now %%item_customer_reviews%% Originally posted 2020-12-26 04:05:49. Republished…

Meta Quest 3 128GB— Breakthrough Mixed Reality — Powerful Performance — Asgard’s Wrath 2 Bundle

Get the epic new Asgard’s Wrath 2 included (a $59.99 value)* when you buy Meta Quest 3 128GB*.Dive into extraordinary experiences with a mixed reality headset that transforms your home into an exciting new playground, where virtual elements blend into your actual surroundings.It’s the most powerful Quest yet*, featuring next-level performance with more than double…

High Probability Options Trading

High probability options trading is all about trades that give you be best chances to be successful. We use Iron Condors, Broken Wing Iron Condors, Butterflys and Strangles to give us the best chances for successful trades based on current market conditions, option delta and volatility. We do not use chart patterns to enter trades,…