Buy Now Press, Classy Click Buy Now for Updated Price. Estimated Price: $5.85 Click Buy Now for Updated Price. Estimated Price: 5.85 Buy Now %%item_customer_reviews%% Originally posted 2024-03-02 23:56:53. Republished…

Category: Mutual Funds

Mutual funds are a type of financial vehicle (special purpose company) which is made up of a pool of money which has been invested by many investors. The investors invest their money in mutual funds so that it can be invested into securities like stocks, bonds, financial instruments and other investment options. Mutual funds give investors acess to a professionally managed, well diversified portfolio. The sharing ration in a mutual fund is proportionally to the amount of investment.

Most mutual funds operate with a specific objective and purpose and thus their investment portfolio reflects the stated objective. Mutual funds are managed by professional fund managers whose job is to invest the funds in the most efficient manner possible to maximize the gains for the investors participating in the fund.

Mutual funds give small or individual investors access to professionally managed portfolios of equities, bonds and other securities. Each shareholder, therefore, participates proportionally in the gains or losses of the fund. Mutual funds invest in a vast number of securities, and performance is usually tracked as the change in the total market cap of the fund—derived by the aggregating performance of the underlying investments.

Investors can invest in mutual funds for the short term or the long term, short term gains are low whereas long term gains are high because in the long term the money can be reinvested to produce exponentially increasing returns.

Eat Sleep Trade Repeat Day Stock Trading Fan Gift T-Shirt

Funny stock trading “Eat Sleep Trade Repeat” design. Great gift for new licensed stock trader, broker, financial planner, money manager, investor, investment banker, cryptocurrency investment trader, Bitcoin or crypto enthusiast, or a millionaire!Currency traders, mutual fund managers, stocks, bonds, retirement funds. Great Christmas 2021 or 2022 Birthday or New Years gift for mom, dad, uncle,…

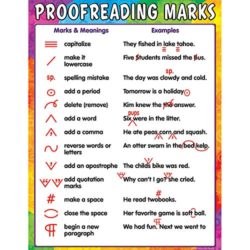

Teacher Created Resources Proofreading Marks Chart, Multi Color (7696)

Related lessons and activities are provided on the back of every chart.Each chart measures 17 x 22 Inches.Shiny, protective coating for durability

Passive Trading: How To Generate Consistent Monthly Income From The Stock Market In Just Minutes A Day

Buy Now Sama, Allen Click Buy Now for Updated Price. Estimated Price: $19.99 Click Buy Now for Updated Price. Estimated Price: 19.99 Buy Now %%item_customer_reviews%% Originally posted 2020-11-01 00:01:16. Republished…

Common Sense on Mutual Funds

John C. Bogle shares his extensive insights on investing in mutual funds Since the first edition of Common Sense on Mutual Funds was published in 1999, much has changed, and no one is more aware of this than mutual fund pioneer John Bogle. Now, in this completely updated Second Edition, Bogle returns to take another…

Check/ Debit Card Register: 8.5 X 11, 100 pages, Butterflies on blue background cover design

Buy Now Afar, Myles Click Buy Now for Updated Price. Estimated Price: $7.99 Click Buy Now for Updated Price. Estimated Price: 7.99 Buy Now %%item_customer_reviews%% Originally posted 2023-11-03 13:04:03. Republished…

The White Coat Investor: A Doctor’s Guide To Personal Finance And Investing

Written by a practicing emergency physician, The White Coat Investor is a high-yield manual that specifically deals with the financial issues facing medical students, residents, physicians, dentists, and similar high-income professionals. Doctors are highly-educated and extensively trained at making difficult diagnoses and performing life saving procedures. However, they receive little to no training in…

The Illiterate Investor: Simple Strategies to Invest in the Stock Market

Buy Now Pineda, Rene Click Buy Now for Updated Price. Estimated Price: $17.95 Click Buy Now for Updated Price. Estimated Price: 17.95 Buy Now %%item_customer_reviews%% Originally posted 2020-12-10 17:57:33. Republished…

ArtSkills Chisel Edge Jumbo Permanent Marker, Black (PA-1447)

Made in ChinaPackage length :8.0 “Package width :2.5 “Package height :1.6 “Permanent Marker

I Never Dreamed I Would Be A Super Cool Mutual funds analyst But Here I Am Crushing It – Mutual funds analyst Notebook And Journal Gift: Lined … 120 Pages, 6×9, Soft Cover, Matte Finish

Are You Looking For A Cute Gift For A Mutual funds analyst ? Or Searching For A Great Mutual funds analyst Themed Notebook For Yourself?This 120 Pages 6×9 Inch Composition White Blank Lined Diary Notebook Journal is a Great Gift Idea for Girls, Boys, Men and Women for Writing Notes, To-Do List. This 120-page journal features:120…