Includes uptrend graph, and a prominent style in investing and trading INDEX AND CHILL. Good news! Mutual fund indices can trace and sometimes, outperform the local bourse’s stock index. Want a hassle free kind of investment? This is the best fund for you!Our FUNNY INDEX TRACKING AND CHILL INVESTING MUTUAL FUND SHIRT makes a nice…

Category: Mutual Funds

Mutual funds are a type of financial vehicle (special purpose company) which is made up of a pool of money which has been invested by many investors. The investors invest their money in mutual funds so that it can be invested into securities like stocks, bonds, financial instruments and other investment options. Mutual funds give investors acess to a professionally managed, well diversified portfolio. The sharing ration in a mutual fund is proportionally to the amount of investment.

Most mutual funds operate with a specific objective and purpose and thus their investment portfolio reflects the stated objective. Mutual funds are managed by professional fund managers whose job is to invest the funds in the most efficient manner possible to maximize the gains for the investors participating in the fund.

Mutual funds give small or individual investors access to professionally managed portfolios of equities, bonds and other securities. Each shareholder, therefore, participates proportionally in the gains or losses of the fund. Mutual funds invest in a vast number of securities, and performance is usually tracked as the change in the total market cap of the fund—derived by the aggregating performance of the underlying investments.

Investors can invest in mutual funds for the short term or the long term, short term gains are low whereas long term gains are high because in the long term the money can be reinvested to produce exponentially increasing returns.

BECOME A CROREPATI: INVEST IN INDIAN MUTUAL FUNDS

Buy Now Market, Mr Click Buy Now for Updated Price. Estimated Price: $10.00 Click Buy Now for Updated Price. Estimated Price: 10.00 Buy Now %%item_customer_reviews%% Originally posted 2022-07-14 00:02:02. Republished…

Vanguard Mutual Funds Investors’ Almanac

We present a simple quantitative method that improves the mutual fund returns across various market segments. Monthly historical data – going back to 1988 – are investigated to demonstrate a tactical asset allocation framework utilizing the Vanguard family of mutual funds covering multiple market segments:-US Bond MarketsoTreasury, Agency BondsoCorporate BondsoTax Exempt BondsoTraditional (Multi-Purpose) Bonds-Global Bond…

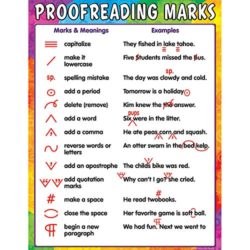

Teacher Created Resources Proofreading Marks Chart, Multi Color (7696)

Related lessons and activities are provided on the back of every chart.Each chart measures 17 x 22 Inches.Shiny, protective coating for durability

Investing: Invest Like A Pro: Stocks, ETFs, Options, Mutual Funds, Precious Metals and Bonds

WOULDN’T IT BE GREAT IF YOU COULD WATCH YOUR OWN MONEY GROW ITSELF TO EXPONENTIAL PROPORTIONS? ISN’T IT EVERYONE’S DREAM TO ACHIEVE WEALTH?Unfortunately, having a regular office job these days does not guarantee that you could maximize your income potential. Costs of goods have constantly been going through the roof that it has become difficult…

Dividend Stocks FD

Expert advice on a mature, reliable way to invest money According to Fortune magazine, investing in dividends is one of the top five ways to survive market instability. Dividend Stocks For Dummies gives you the expert information and advice you need to successfully add dividends to your investment portfolio, revealing how to make the most…

How to Invest for Retirement: A Simple Path to Retiring Rich, Independent, and Free

“From a retired teacher – simple is better. This book works!” ✰✰✰✰✰ Amazon ReviewerThis easy-to-read Amazon-Bestseller guide answers all your questions about investing for retirement:Why is time value of money important?How compounding works in index fundsWhat is the best way to invest for retirement?What are some common investing mistakes?Where to invest for retirement?Where to invest…

Don’t Mess With Me I Am A Mutual funds analyst: Career journal, notebook and writing journal for encouraging men, women and kids. A framework for building your career.

Keeping a journal is a very good activity. If you like to focused on career than you should get a copy of this amazing and hilarious journal. It is time for you to get this amazing writing notebook and start to write your daily routine in this journal This writing journal is available for men,…

Investors Behavior of Mutual Fund Investment

Mutual fund pools the money of different investors. This money is then invested across stocks, bonds, market instruments. Mutual fund is more reliable to the investors as the risk is low when compared to other sources of investment.Ordinary investors have to choose the schemes, got return to difficult. Mutual fund industry has evolving recently, but…

The ETF Book: All You Need to Know About Exchange-Traded Funds

Exchange-traded funds (ETFs) are revolutionizing the investment industry. From their introduction in 1993, ETFs have expanded exponentially over the past fifteen years. You, as an informed investor, need to know what makes ETFs unique, how they work, and which funds may help you achieve your financial goals. The updated edition provides the most current look…